is there a death tax in texas

There is a federal tax where the IRS taxes portions of your estate. First there are the federal governments tax laws.

Texas Longhorns University Mark Poster Zazzle Com In 2022 University Of Texas University Texas Logo

The only types of taxes that apply in Texas after a person dies are income taxes gift taxes property taxes and federal estate tax.

. Texas does not levy an estate tax. This final tax isnt anything that you or your estate would be. There is a Federal estate tax that applies to estates worth more than 117 million.

The big question is if there are estate taxes or inheritance taxes in the state of Texas. There are two types of estate taxes that can be imposed after death. There is a 40 percent federal.

The short answer is no. This is because even though an estate tax still exists on the books for the IRS the size of the exemption is so. The Texas Probate Code Title 2 Subtitle E Chapter 201 is the law.

In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. In some states individual inheritors are charged a state inheritance tax on top of federal inheritance taxes. It is one of 38 states with no estate tax.

Tax is tied to federal state death tax credit. Estate taxes and inheritance taxes. Call or Text 817 841-9906.

Taxes imposed by the federal andor state government on someones estate upon their death. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. The federal estate tax sometimes called the death tax is a one-time tax that is imposed at death.

However other stipulations might mean youll still get taxed on an inheritance. Only 12 states plus the District of Columbia impose an estate tax. The imperiled federal estate tax exemption Everything over the exemption amount is taxed at 40 the minute after you take your last breath.

Texas does not have an estate tax. Taxes levied at death based on the value of property left behind. In addition to taxes due at the federal and state level there is also another tax known as an inheritance tax.

A persons death terminates his or her taxable year. At the state level there is not an estate tax in Texas to be concerned about by anyone but at the federal level there is. What Is the Estate Tax.

Prior to September 15 2015 the tax was tied to the federal state death tax credit. A final income tax return will be required if the decedents income exceeds the filing thresholds established under the. The federal estate tax is a tax on your right to transfer property at your death.

UT ST 59-11-102. Tax was permanently repealed effective as of September 15 2015 when Chapter 211 of the Texas Tax Code was repealed. Second there are certain deductions that may be taken from the gross value of ones estate for estate tax purposes including mortgages and other debts estate administrations and property left to qualified charities.

It only applies to estates that reach a certain threshold. Does Texas Have Its Own Estate Tax. There are not any estate or inheritance taxes in the state of Texas.

Live Call Answering 247. Texas is one of the states that do not collect estate taxes. The federal government and some state governments impose estate taxes on decedents estates.

Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive. Inheritance tax also called the estate tax or death tax is levied at both the federal level and state level and applies to any assets transferred to someone other than the deceaseds spouse at the time of death. These taxes are levied on the beneficiary that receives the property in the deceaseds will.

Currently estates under 114 million are. Texas does not have an estate tax either. Intestate succession laws affect only assets that are typically covered in a will specifically assets that you own alone like real estate stock market investments businesses and other types of physical.

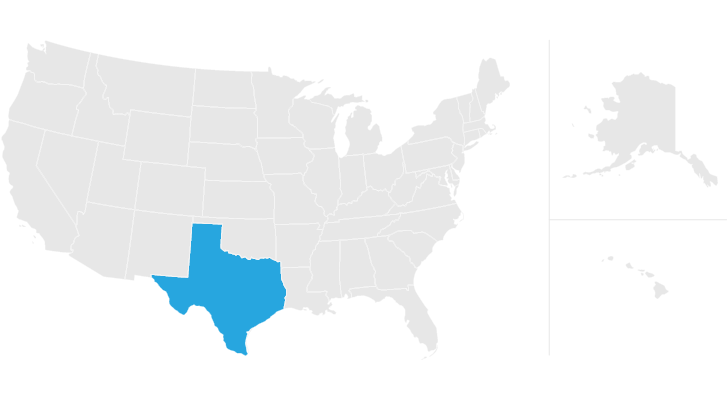

Estate tax return within 9 months of the death. No not every state imposes a death tax. Texas does not have a state-level estate tax but some other states do.

And depending on where you live there may be state-level taxes due as well. Death and taxes. The estate tax sometimes referred to as the death tax is a tax levied on the estate of a recently deceased person before the money passes on to their heirs.

Theres no estate tax in Texas either although estates valued at more than 1206 million can be taxed at the federal level as of 2022. Does every state impose a death tax. Death Taxes in Texas.

While Texas does not impose a state inheritance or estate tax if you die without a will your assets will be distributed through the states intestate succession process. And some states levy inheritance taxes on people. This means that if a person passes away on June 1 2009 that persons final income tax return will cover only the period from January 1 2009 until June 1 2009.

Each state controls the functioning of this process through the intestacy succession laws found in that states probate tax code. Six additional states also levy an inheritance tax. Texas Estate Tax.

When a Texas resident dies without having made a last will and testament they are automatically entered into the states intestacy probate process. Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance tax on September 15 2015. Inheritance Tax Laws in Texas.

However less than 1 of the population in Texas or even in the United States needs to worry about this. There are two main types of death taxes in the united states. In fact only New Jersey Nebraska Maryland Kentucky Iowa and Pennsylvania collect estate taxes.

While there is no state inheritance tax in Texas your estate may be subject to the federal estate tax. It consists of an accounting of everything you own or have certain interests in at the date of death. However there is still a federal estate tax that applies to all property that exceeds the 1206 exemption bar if a person has deceased after January 1 2022.

Talking Taxes Estate Tax Texas Agriculture Law

Can You File For Guardianship Without A Lawyer In Texas Guardianship Lawyer Attorneys

Real Estate Map Search And Texas Real Estate Banos De Lujo Bano De Lujo Armario De Lujo

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

Four Types Of Deeds In Texas 1 General Warranty Deeds 2 Special Warranty Deeds 3 No Warranty Deeds 4 Quitc Power Of Attorney Knowledge The Hamptons

How To Avoid Probate People Thinks It S Only For The Rich If You Own Over 25k Cash Then You Mus Estate Planning Estate Planning Checklist Funeral Planning

Texas Estate Tax Everything You Need To Know Smartasset

Usa State Taxes 2017 950 5b Usa Veterans Veteran Owned Business Volunteer Services

Puede Un Beneficiario Ser Fideicomisario De Un Fideicomiso Irrevocable Estate Planning Personal Finance Trust

What Is The Probate Process In Texas A Step By Step Guide

Time To Examine The 16th Amendment Before 1913 We Kept 100 Of Our Income And We Still Had Roads 16th Amendment Texas History Historical Events

Cadilac Law Pllc Photos Business Profile Management Awareness

Route Of Kennedy Motorcade Past Texas School Book Depository In Downtown Dallas Jfk Org Jfk Jfk Assassination George Bush